Transition Strategy

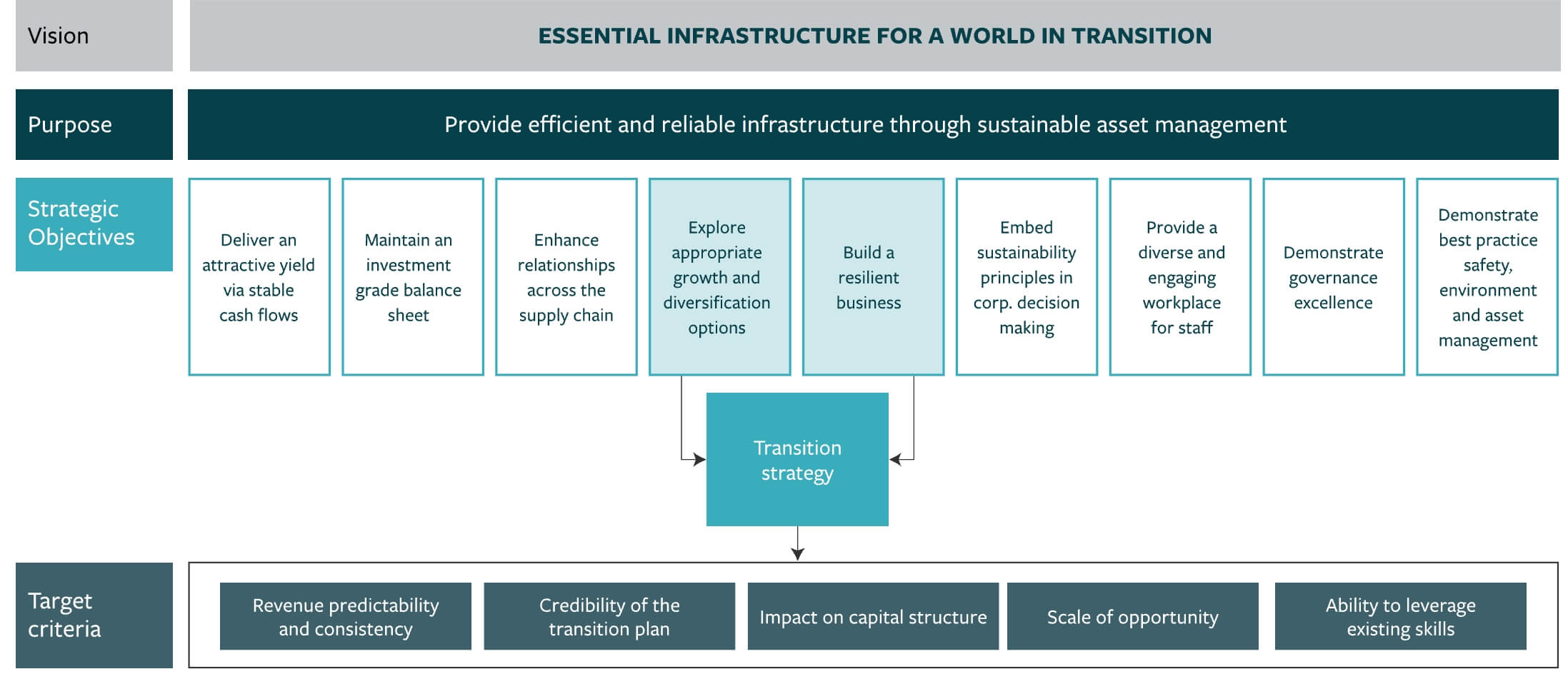

DBI’s vision and purpose is to provide essential infrastructure for a world in transition. DBI’s vision is broader than any single asset or commodity. It incorporates expectations of continuing investment in the maintenance, growth and diversification of DBT while also exploring long term growth opportunities to diversify DBI’s infrastructure portfolio.

In support of this vision and purpose, DBI developed a transition strategy to guide its strategic response to the climate related risks and opportunities arising from the expected transition of the global economy to a low carbon future. Despite the expected long-term demand for high quality metallurgical coal to support the steel industry, DBI is increasingly aware that environmental, social and governance drivers and international commitments towards Net Zero may impact its DBT business. DBI’s key stakeholders are keen to understand how DBI intends to plan for the transition and diversification of its business to meet the needs and challenges of a world in transition. While DBI remains confident of the continued viability of DBT beyond 2050 under various transition scenarios, the Company believes that exploring opportunities for growth and diversification both at DBT (through feasibility projects like the 8X expansion and our hydrogen export project) and through new infrastructure opportunities will enable DBI to build resilience to climate-related risks and to grow enterprise value over the coming decades.

Based on third party supply and demand forecasts, DBI expects to be generating material revenues from the continuation of the coal handling service at DBT beyond 2050 under a range of climate-related scenarios, including Net Zero by 2050.

However, in order to build resilience and grow value, DBI considers it prudent to diversify the businesses of both DBI and DBT. The forecast long-term need for metallurgical coal in the steel production process provides significant time for DBI to create value and build resilience through the process of diversification. DBI intends to pursue diversification by:

- investigating options for the expansion of the existing infrastructure at DBT for non-coal purposes. DBI’s feasibility studies into the potential for hydrogen exports through DBT is an example of this approach; and

- proactively reviewing opportunities to develop or acquire third-party infrastructure assets.

When assessing opportunities for diversification, beyond the customary commercial analysis, DBI will consider the following assessment criteria:

- Revenue predictability and consistency – essential infrastructure that is likely to generate long-term, stable and predictable revenues (regulated or unregulated);

- Credibility of the transition plan – the resilience of the target to climate-related transition risks under the range of IEA (or equivalent) climate scenarios;

- Impact on capital structure – the degree to which choices can be made around capital sources and uses to increase business resilience;

- Scale of the opportunity – the value to be unlocked by the project or asset; and

- Competitive advantage and ability to leverage existing skills – the extent to which DBI can utilise its expertise in regulation, project management and asset development to gain an advantage over incumbents and potential new entrants.